Business Structure Mistakes CFO Firms Must Avoid: A Practical Guide

Picking the right business structure is one of the most important decisions CFO firms face. Statistics show that all but one of these small businesses operate as sole proprietorships. This simplest form of business structure puts owners at risk with personal liability against business obligations. The shift from solo consultant to firm owner needs more than just hiring staff – you need a structure that lets you step away from client work and lead your growing business.

Your choice of business structure shapes everything – from tax payments to fundraising options, paperwork needs, and your personal liability exposure. CFO consulting firms need this decision even more because they can scale by adding consultants without reaching personal capacity limits. On top of that, it opens different paths to growth – corporations can sell shares for capital, while partnerships and sole proprietorships channel profits straight to owners who report earnings on personal tax returns.

Many CFO firms get pricey mistakes in their initial business structure setup. They realize their choice blocked growth opportunities or created extra tax loads too late. This piece walks you through four major business structure pitfalls that CFO firms should dodge to build lasting success and scalability.

Mistake 1: Choosing the Wrong Business Structure

CFO firm owners often don’t realize how their original business structure choice will affect them years down the road. This decision goes way beyond paperwork. Your firm’s financial future and how it operates depend heavily on this choice.

Why structure matters for CFO firms

Your chosen structure sets the rules for your personal liability exposure, tax obligations, and how much you can grow. Clients judge your firm’s reliability and professionalism based on its structure. Limited liability structures protect your personal assets from business debts. This protection becomes crucial for consulting firms where client disputes might arise from your advice. Some structures make raising money easier – corporations can sell ownership shares, but partnerships and sole proprietorships can’t. The wrong structure could hold back your CFO firm’s growth plans.

Common misconceptions about LLCs and S-Corps

People often think S-Corps are like LLCs or corporations. The truth is S-Corp status is just a tax choice for existing businesses. LLCs give good protection but won’t shield you if you mix personal and business money. Some say LLCs work only for small businesses, but look at Amazon – they run multiple LLCs. The tax rules differ too. LLC owners pay self-employment taxes on everything they earn. S-Corp owners pay these taxes only on their salary, not distributions. This tax difference can save qualifying businesses thousands each year.

When to consult a business structure consultant

Your business should bring in $40,000-$50,000+ in yearly net profits before you talk to a professional. The tax savings at this level usually cover the extra paperwork costs of complex structures. Experts help figure out if you can pay yourself a “reasonable” salary – something the IRS demands from S-Corps. You should also get expert help before expanding your business. Making structure changes later can get pricey and complicated. These consultants know the complex rules that keep your tax status safe.

Mistake 2: Lack of Defined Roles in the Consulting Firm Structure

A clear definition of roles serves as the life-blood of successful CFO consulting firms. Companies that lack this clarity find it hard to scale and hit growth barriers they could have avoided.

Blurred lines between partners and consultants

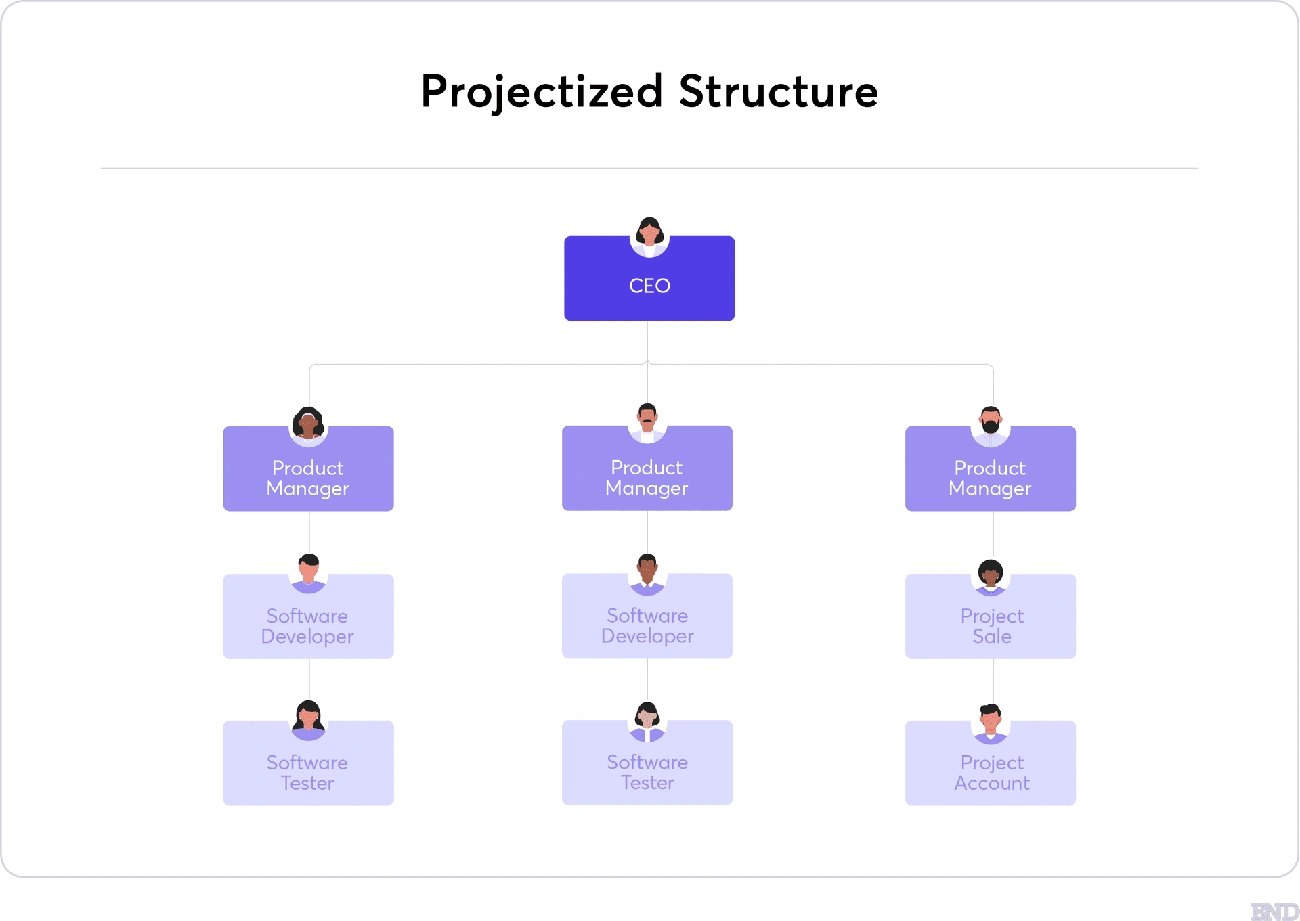

Small CFO firms often have team members who do “a little bit of everything.” This versatility creates problems. The company’s accountability and efficiency drop as it grows. Partners should focus on vision, strategy, and relationship management. Consultants need to handle project delivery. The company’s growth demands a change from an org chart with individual names to one with defined positions. This creates the specialization and boosted productivity that growing firms need.

The risk of over-dependence on founders

Consulting firms under $7 million in revenue face their biggest challenge – they depend too much on founders for business development. This creates a dangerous bottleneck. The next generation of directors or partners lacks the power to drive growth on their own. Buyers notice this dependency on the founder’s personal skills and networks, which results in lower valuations. Many seniors wrongly see the founder’s success in business development as some kind of “magic” they can’t copy. The truth is that success came from necessity and consistent effort.

How to build a scalable consulting business structure

You need intentional design to build an expandable consulting business structure:

- Define clear roles and responsibilities early, even in small teams

- Assign dedicated managers once your firm exceeds 30 employees

- Develop leadership from within rather than solely hiring externally

Founders must overcome their fear of letting go. They should trust their successors and let them learn from their mistakes. Good mentorship, network introductions, and sales training help seniors succeed. As companies grow, part-time functions become full-time roles. The path to a truly expandable structure begins only when we are willing to see partners as leaders and stewards rather than involving them in every operational decision.

Mistake 3: Ignoring Financial Oversight in Organizational Design

CFO consulting firms face an interesting paradox – they often neglect their own financial oversight while advising others. Many firms fail to build resilient financial governance systems in their own operations.

Why CFO firms need their own CFO mindset

These firms should practice what they preach when it comes to financial oversight. Their operations need constant financial performance monitoring, strong internal controls, and clear financial reports. Research shows interesting results. Companies that build organizational resilience are 6.5 times more likely to focus on talent management. They’re also 4.3 times more likely to embrace digital capabilities and analytics.

Overlooking internal cash flow and forecasting

Professional service firms depend heavily on cash flow. Project-based revenue creates income streams that are inconsistent and sort of hard to get one’s arms around. A solid cash flow management strategy needs three key elements. First, create rolling 12-month projections. Second, build cash reserves for 3-6 months of expenses. Third, set up resilient billing processes.

Failure to track KPIs and profitability by service line

Industry experts point to several crucial KPIs for consulting firms. Project profitability margins, revenue per employee, and profit margins by service line top the list. These numbers show which services bring the best returns. This knowledge helps firms adjust their pricing and improve their service mix. Companies that skip service line profitability tracking miss valuable chances to allocate resources better and find strategic growth opportunities.

Mistake 4: Scaling Without Operational Systems

A CFO consulting firm without resilient operational systems is like a house without a foundation—it will eventually collapse under its own weight.

Hiring before defining processes

CFO firms often make a crucial mistake. They expand their team before setting up standardized workflows. Financial teams need strong foundations before they scale—not after. This approach creates inconsistent service delivery and operational bottlenecks. A full picture of processes helps identify constraints before they affect growth.

No clear onboarding for new consultants

A structured onboarding process affects consultant’s retention and productivity. All the same, many firms don’t have defined training protocols. The best approach has new financial advisors create their own sample financial plans. This gives them hands-on software experience. On top of that, matching new consultants with experienced mentors gives them vital guidance in their first months.

Lack of project management infrastructure

Project managers and CFOs work at opposite ends of the spectrum. One looks at future timetables while the other focuses on past expenses. Projects often exceed budgets and deadlines without a bridge between these functions. Making shared project management systems work becomes vital to scale operations.

Neglecting automation and tech tools

Failure to make use of information limits growth potential. Cloud-native financial tools help teams work from anywhere and scale smoothly with growing transaction volumes. Financial automation changes finance from a back-office burden into a strategic powerhouse.

Conclusion

Success in building a CFO firm needs more than just financial expertise. This piece highlights four structural mistakes that can substantially hurt your firm’s growth potential and longevity.

Your business structure creates the foundation for future success. Many CFO consultants pick the simplest option at first without thinking about long-term effects on liability, taxation, and scalability. Smart business sense suggests talking to structure specialists when your firm starts making consistent profits.

Role definition becomes crucial as your firm grows. Your firm’s efficiency suffers when partner and consultant responsibilities overlap. Too much dependence on founders can hold back growth. Smart firms create expandable organizational designs that help develop leaders and reduce founder dependency.

CFO firms often miss a crucial point – they don’t watch their own finances, the exact service they offer clients. Your organization needs proper financial governance, resilient cash flow management, and service-line profitability tracking. Practicing what you preach builds credibility with potential clients.

Simplified processes power scalable growth. Firms should set up standard workflows, detailed onboarding procedures, and project management tools before growing their teams. These systems, combined with strategic automation, let your firm expand smoothly without quality loss.

The trip from solo consultant to successful CFO firm needs careful planning. Mistakes happen, but avoiding these four crucial pitfalls will substantially boost your chances of building a resilient, profitable, and more valuable consulting practice. Your future self will without doubt appreciate this foresight.