The Client Report Template System That Saved Me 10 Hours Per Week [CFO Guide]

My client reports used to consume nearly a quarter of my workweek until I found that there was a better approach. My role as a fractional CFO comes with rates between $250-$400 per hour, and spending countless billable hours on routine reports made no sense, especially when 38% of startups fail because they run out of cash.

This struggle with reports isn’t just my story. Many financial professionals face the same challenges – inconsistent formats, data entry mistakes, and precious time wasted on formatting. The stakes are high since fractional CFO services cost clients about $8,000 to $16,000 monthly. Clients need quick value and expect ready-to-use datasets that guide their decisions before their cash runs dry.

My journey of trial and error led me to create a client report template system that revolutionized my practice. The results were dramatic – I saved 10 hours each week. My standardized templates ensure accuracy, consistency, and timely delivery of reports. New clients benefit from this system right away, and the evidence-based insights showcase my expertise.

Let me show you how I built this system. You’ll learn about the four templates that changed everything and ways to make your financial reporting more efficient.

The problem with traditional client reporting

Financial professionals still spend too much time and effort on client reporting tasks. Recent studies show 26% to 39% of workers waste time typing data manually, and 48% of companies still use manual spreadsheets to record information.

Manual data entry and formatting issues

Manual data entry mistakes happen about 1% of the time, which might not seem like much. But these small errors create a domino effect throughout financial reports and can lead to serious problems. Small mistakes often result in wrong calculations, incorrect financial reports, and tax filing errors. Teams end up wasting extra hours to find and fix these errors—basically doing everything twice.

The manual data export process creates many bottlenecks:

- Log into client’s accounting software

- Export P&L statements

- Download CSV files

- Open Excel and copy/paste data

- Fix broken formulas

- Repeat for each client

Inconsistent structure across reports

CFO firms face a big challenge with reports lacking standard formats, timing, and detail levels. Clients find it hard to track their progress and compare numbers because of these differences. Report variations between periods make clients doubt the firm’s expertise and reliability.

Traditional reporting methods show lots of metrics but fail to explain why numbers change or how they affect client goals. Reports often contain complex data and industry jargon, yet only 10% of clients really understand these numbers.

Time lost on repetitive tasks

Each client report takes account managers up to 5 hours every month. This adds up quickly for fractional CFOs with multiple clients—consultants waste 15-20 hours monthly on paperwork instead of doing billable work.

Reports become outdated before clients even look at them. Manual processes create an endless loop: data collection, error fixes, and explaining unclear numbers to clients. These constant interruptions stop skilled professionals from doing strategic work that actually adds value.

How I built a reusable client report template system

My firsthand experience with traditional reporting showed me its flaws. This pushed me to develop a systematic approach that standardized and automated client reporting. The idea was straightforward but bold – I wanted to create templates that would deliver quality reports consistently and slash production time.

Identifying repeatable elements in reports

I started by looking at dozens of past client reports to spot common patterns. The results were eye-opening. Every client, whatever their industry, needed five foundational reports: Monthly P&L, Cash Flow Forecast, KPI Dashboard, Budget vs. Actual, and Cash Runway. These core reports tell the complete financial story that works for any business model or sector.

My analysis helped me map out which sections stayed the same between clients and which needed customization. Each report type revealed:

- Standard calculation methods

- Key visual elements (charts and tables)

- Common footnotes and explanations

- Critical performance indicators

Choosing the right tools for automation

Finding software that could automate these reports without losing quality became my next challenge. The tools needed direct connections to client accounting platforms so we could say goodbye to the export nightmare.

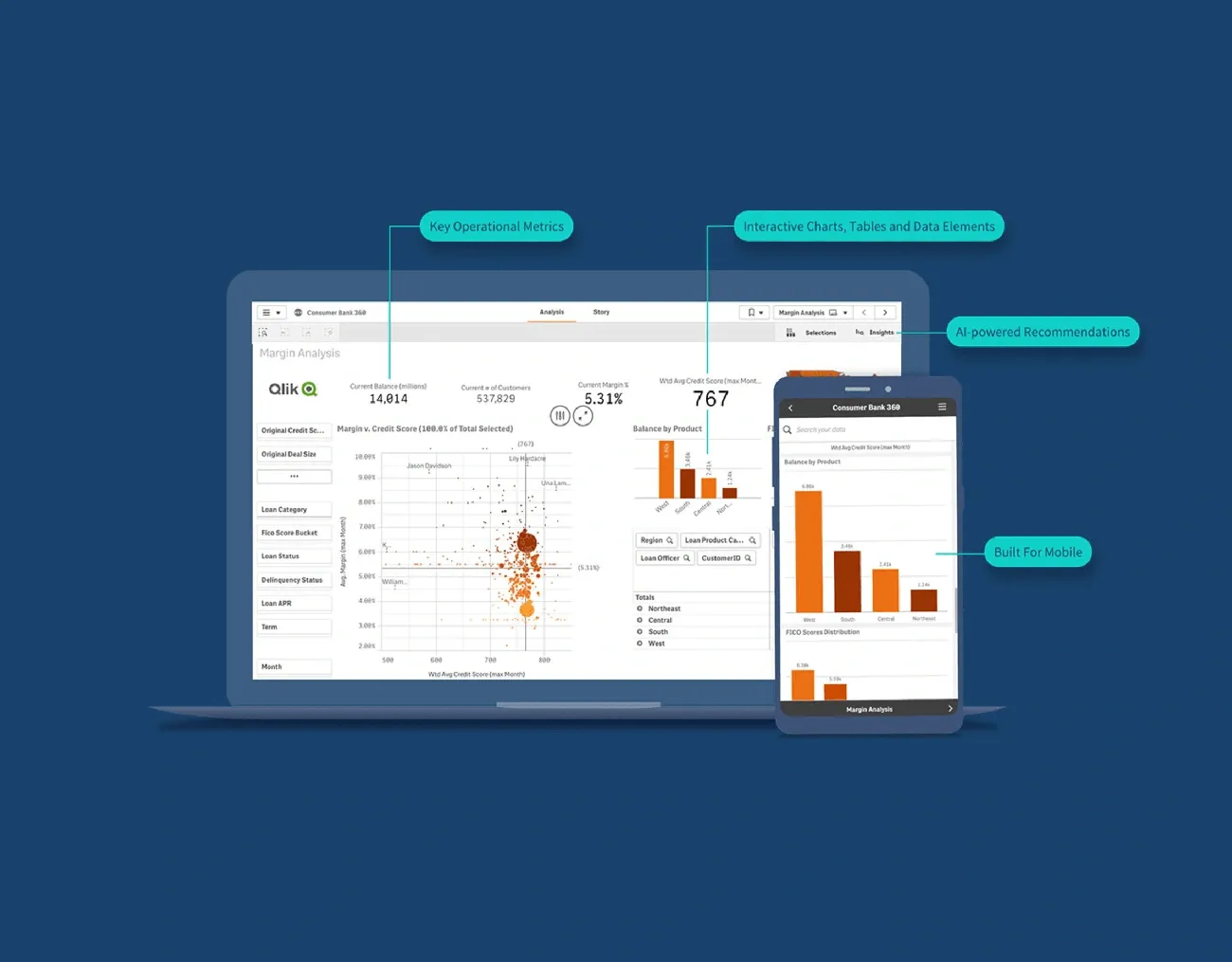

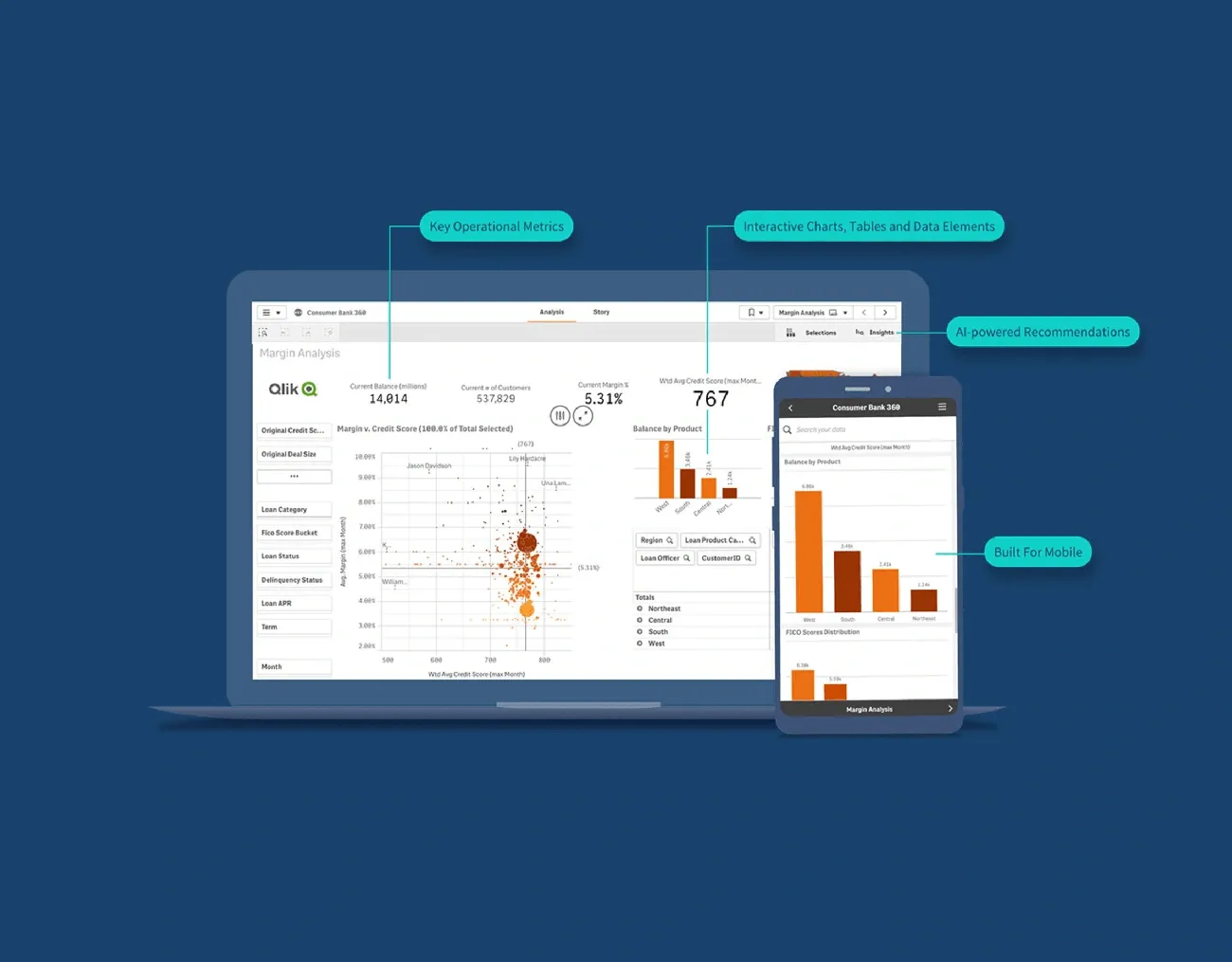

My original experiments with several options led me to pick a mix of specialized project management software and accounting integrations. The perfect system pulls data automatically from QuickBooks, Xero, NetSuite, and Stripe. Data flows straight into templates on any schedule you want—daily, weekly, or monthly.

The right automation tools also boosted accuracy. They eliminated typos from manual entry and made sure reports always showed the latest financial data.

Creating a master client reporting template

Building standardized templates in Excel and Google Sheets became the final piece. These templates are the foundations for all client reporting. Each template has:

- Consistent visual formatting and branding

- Automated variance calculations

- Side-by-side comparisons with explanatory sections

- Clearly defined areas for commentary and analysis

These master templates save approximately 75% of the time you’d normally spend gathering data. This leaves more time for valuable analysis. Every client gets the same high-quality reporting experience, whatever their size or sector.

The 4 client report templates that saved me 10 hours per week

My time-saving system relies on four custom client report templates that revolutionized my workflow. These specialized templates are the foundations of a detailed reporting framework that cut my workload significantly.

Executive Summary Template

The executive summary template gives C-level clients exactly what they need to make decisions. A single page has branded cover elements, key progress charts, and vital KPIs that put everything in context. The template filters automatically to show the most important outcomes and budget status without excess detail.

Key Metrics Snapshot Template

I created a metrics snapshot to track deliverables and project phases that shows milestone progress bars and visual timelines. The template uses color coding to spot troubled tasks right away and pulls summary stats straight from financial platforms. This enables quick decisions and makes managing multiple clients easier.

Visual Data & Charts Layout

The visual data template makes complex information easy to read without losing any details. Through well-laid-out tables and interactive charts, the template shows financial data in ways clients understand naturally. Clear visuals build client trust and reduce questions about complex financial ideas.

Action Items and Recommendations Block

The final template goes beyond just showing data to give clear next steps. A dedicated “Highlights and Issues” section flags budget risks and project roadblocks. Specific recommendations address identified problems directly, making financial reports a strategic tool rather than just a look back at past performance.

The results: What changed after using the system

The client report template system I created delivered amazing results that changed several aspects of my practice. Results came quickly and lasted.

Time saved per report

My reporting time dropped 75% per client. Client reports that used to take 5 hours monthly now take just over an hour. This saved my practice about 10 hours every week. I now use this extra time for revenue-generating activities and planning ahead. Another agency that used a similar system saved 750 hours each month.

Improved client satisfaction and retention

Client retention rates grew substantially. Our transparent reporting format helped build trust with clients like never before. They loved having 24/7 access to their financial data. This eliminated their worry about waiting for updates. Clients became more involved in our discussions because they could see the data-backed story of their financial progress clearly.

Faster team collaboration and fewer errors

The template system eliminated manual data entry errors that used to cause problems in our reporting. My team now spends 30-40% less time preparing data and more time analyzing it. Our approval process became quicker. The centralized templates let everyone access the same information at once. The client report template system changed our reporting process and the way we deliver our services.

Conclusion

My CFO practice changed completely when I built a client report template system. It freed me from manual tasks and let me focus on work that creates real value. The system relies on four templates: Executive Summary, Key Metrics Snapshot, Visual Data Charts, and Action Items. These templates are now the foundations of how I communicate with clients.

The new system cut my reporting time by 75% for each client and saved me 10 hours every week. This meant I could use my $250-$400 hourly rate to help clients grow instead of formatting reports.

Client retention improved too. My clients love having their financial data available 24/7 through a clear, consistent reporting format. They don’t have to wait anxiously for updates and can make smart decisions before running out of money.

You might be stuck doing manual data entry with scattered reporting methods that waste your time. The quickest way out is to build your own template system. Look at what repeats in your reports, pick the right tools to automate, and create templates that maintain quality while saving time.

The benefits go beyond just saving time. Your team’s cooperation improves, mistakes drop, and clients get the expert guidance they pay for. Setting up takes work, but the payoff makes it worth the effort. My practice runs better now – clients are happier, and I spend more billable hours on strategic work that showcases my expertise.